Buying a car in the Philippines has become easier than ever — thanks to flexible auto loans and financing options from banks and car dealers. But before you sign that loan agreement, it’s smart to use a Car Loan Calculator Philippines 2026 to see exactly how much you’ll pay every month.

This calculator lets you estimate your monthly amortization, interest cost, and overall payment for new or used vehicles. It’s your essential tool for making sure your dream car fits comfortably within your budget.

🚗 What is a Car Loan?

A car loan (or auto loan) is a type of installment financing that allows you to purchase a vehicle by paying over time — usually from 12 to 60 months. Banks or car dealers lend you the amount to buy the car, and you repay it monthly with interest. You can get loans for:

- Brand-new cars

- Second-hand or used cars

- Car refinancing (transfer existing auto loan for better rates)

The Car Loan Calculator Philippines 2025 helps you estimate how much you’ll pay monthly and the total interest over the loan term.

🚗 How Does the Car Loan Calculator Philippines Calculate Your EMI?

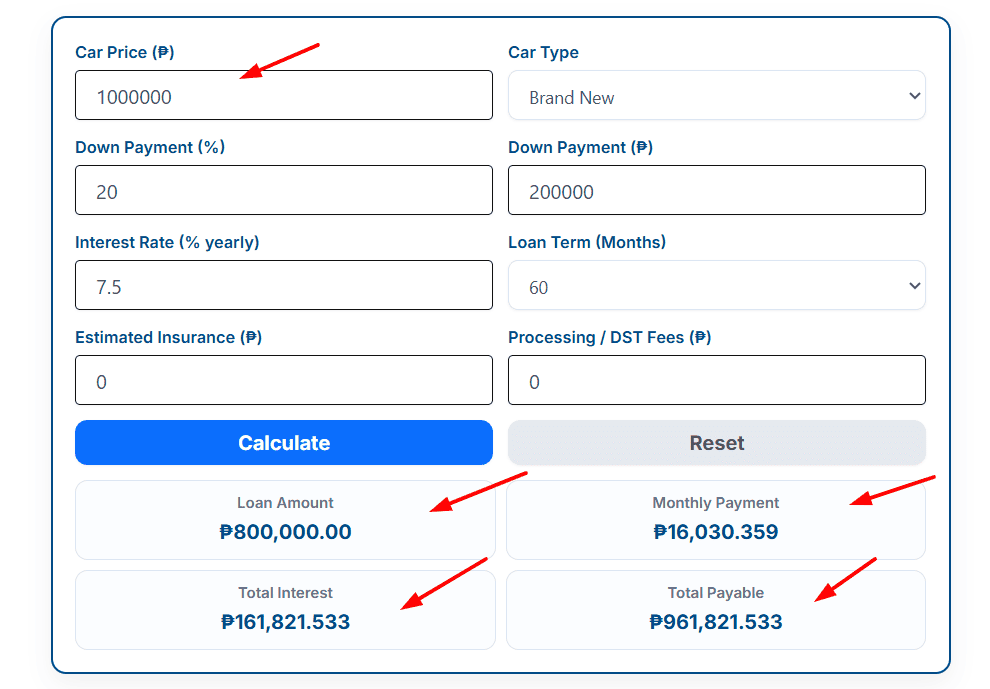

Suppose: I want to buy a brand new car in the Philippines worth ₱1,000,000.

I plan to pay 20% down payment, take a 5-year car loan (60 months) at 7.5% annual interest with monthly payments.

How does this car loan calculator calculate the result?

🧮 Car Loan Calculator Philippines – Step-by-Step?

🔹 Step 1: Enter the car details

You enter the following values in the calculator:

- Car Price: ₱1,000,000

- Car Type: Brand New

- Down Payment: 20%

- Interest Rate: 7.5% per year

- Loan Term: 60 months

- Insurance & Fees: ₱0

👉 The calculator automatically calculates:

- Down Payment Amount: ₱200,000

🔹 Step 2: Calculate the loan amount

The loan amount is calculated by subtracting the down payment from the car price and adding insurance and fees.

Loan Amount

= Car Price − Down Payment + Insurance + Fees

= ₱1,000,000 − ₱200,000 + ₱0 + ₱0

= ₱800,000

🔹 Step 3: Convert annual interest into monthly interest

Because car loan payments are made monthly, the annual interest rate is divided by 12.

Monthly Interest Rate

= 7.5% ÷ 12

= 0.625% per month

🔹 Step 4: Calculate the total number of payments

The calculator determines how many monthly instalments you will pay.

Total Payments

= 60 months

= 60 monthly payments

🔹 Step 5: Apply the car loan EMI formula

The calculator uses a standard EMI (Equated Monthly Installment) formula.

Each monthly payment includes both principal and interest.

In the early months, a larger portion goes toward interest

Over time, more of the payment goes toward principal

Using the formula: EMI=P×r×(1+r)n−1(1+r)n

Where:

- P=₱800,000 (Loan Amount)

- r=0.625%=0.00625 (Monthly Interest Rate)

- n=60 (Number of months)

🔹 Step 6: Display the final results

Based on the entered values, the calculator shows:

Monthly EMI: ≈ ₱16,030.36

Total Amount Payable: ≈ ₱961,821.60

Total Interest Paid: ≈ ₱161,821.60

Loan Term: 60 months

(Values are rounded for easy understanding.)

Notice: The calculation results shown in this example are for informational purposes only.

Actual car loan EMI, interest rates, insurance costs, and processing fees may vary depending on the bank, car dealer, credit profile, and loan terms in the Philippines.

📊 Example Computation (2025)

| Car Price | Down Payment | Loan Term | Interest Rate | Monthly Payment | Total Cost |

|---|---|---|---|---|---|

| ₱1,000,000 | ₱200,000 (20%) | 5 years | 8% | ₱16,220 | ₱973,200 |

| ₱800,000 | ₱160,000 (20%) | 3 years | 9% | ₱20,350 | ₱732,600 |

| ₱1,500,000 | ₱300,000 (20%) | 4 years | 7.5% | ₱28,215 | ₱1,354,320 |

🏦 Top Banks Offering Car Loans in the Philippines (2025)

| Bank | Min. Loan | Max. Term | Interest Rate | Approval Time |

|---|---|---|---|---|

| BDO Auto Loan | ₱100,000 | 6 years | 6%–9% | 3–5 days |

| BPI Family Auto Loan | ₱200,000 | 5 years | 6.3%–9.5% | 5 days |

| Security Bank Auto Loan | ₱400,000 | 5 years | 5.5%–8.5% | 3 days |

| EastWest Bank Auto Loan | ₱200,000 | 6 years | 6.5%–10% | 5 days |

| UnionBank Auto Loan | ₱150,000 | 5 years | 6%–8% | 4 days |

Use the Car Loan Calculator to compare these offers and find the lowest monthly amortization.

⚙️ Steps to Use the Car Loan Calculator

1️⃣ Enter the car price (brand-new or used).

2️⃣ Choose your down payment percentage (usually 20–30%).

3️⃣ Select your loan term (12–60 months).

4️⃣ Input the annual interest rate.

5️⃣ Click Calculate to view your monthly payment and total cost.

This quick simulation gives you a realistic preview of your financial obligation before applying.

💰 Tips to Lower Your Monthly Car Loan Payments

✅ Make a higher down payment (30% or more).

✅ Choose shorter loan terms to reduce total interest.

✅ Maintain a good credit score to qualify for lower rates.

✅ Compare multiple banks and dealer promos.

✅ Check your Net Salary Calculator Philippines 2025 results to ensure affordability.

📈 Car Loan Interest Rates 2026 (Average Market Rates)

| Term | Brand-New Cars | Used Cars |

|---|---|---|

| 12 months | 5.00% | 6.50% |

| 24 months | 6.00% | 7.00% |

| 36 months | 6.75% | 7.50% |

| 48 months | 7.25% | 8.00% |

| 60 months | 8.00% | 8.75% |

🔗 Related Financial Calculators

If you’re planning to buy a car, combine this calculator with:

- Net Salary Calculator Philippines 2025

- 13th Month Pay Calculator Philippines

- BIR Income Tax Calculator Philippines

- Pag-IBIG Housing Loan Calculator

- Personal Loan Calculator Philippines

- Compound Interest Calculator (Philippine Peso Example)

- Electricity Bill Calculator (Meralco Bill Estimator)

- Freelancer Tax Calculator Philippines

🚘 Example: Car Loan Affordability (2026)

Let’s say you’re buying a ₱1,200,000 car.

- Down payment: ₱240,000 (20%)

- Loan amount: ₱960,000

- Term: 5 years

- Interest rate: 7.5%

Result:

- Monthly payment ≈ ₱19,320

- Total payable amount = ₱1,159,200

- Total interest = ₱199,200

If your net salary (after tax and SSS/PhilHealth/Pag-IBIG) is ₱60,000/month, this car loan would consume about 32% of your income — manageable within financial planning standards.

🧾 Fees & Requirements (2025)

Documents Required:

- Valid ID (Government-issued)

- Certificate of Employment / Payslip

- Proof of Billing

- TIN / Latest ITR

- Car quotation from dealer

Possible Fees:

- Processing Fee: ₱1,000–₱2,000

- Chattel Mortgage Fee: ₱5,000–₱10,000

- Insurance Premium: Depends on car value

- Documentary Stamp Tax: ₱1.50 for every ₱200 of loan amount

⚠️ Common Mistakes to Avoid

❌ Ignoring insurance and maintenance costs

❌ Choosing long loan terms just for smaller payments

❌ Not checking for hidden dealer charges

❌ Applying without reviewing your credit report

❌ Overestimating your income stability

Always use your Net Salary Calculator Philippines and SSS, PhilHealth & Pag-IBIG Contribution Calculator to see if your post-deduction income can handle the loan.

💡 Electric Vehicle (EV) Financing – 2026 Trend

With more Filipinos switching to eco-friendly cars, several banks now offer EV car loans with lower interest rates and longer repayment periods.

You can use the Electricity Bill Calculator (Meralco Bill Estimator) to estimate monthly charging costs for your EV.

FAQ

Q1: What is the minimum salary required for a car loan in the Philippines?

Most banks require at least ₱30,000 monthly income for approval.

Q2: Can I get 0% interest car financing?

Yes, but only during dealer promos — and usually for short-term loans (1–2 years).

Q3: Can OFWs apply for car loans?

Yes. Some banks like BDO and BPI offer Auto Loan for OFWs with valid remittance records.

Q4: Can I pay off my car loan early?

Yes, but some lenders may charge a pre-termination fee (1%–5%).

Q5: Can freelancers apply for a car loan?

Yes. Use the Freelancer Tax Calculator Philippines to prepare proof of income (ITR or bank statements).